geothermal tax credit form

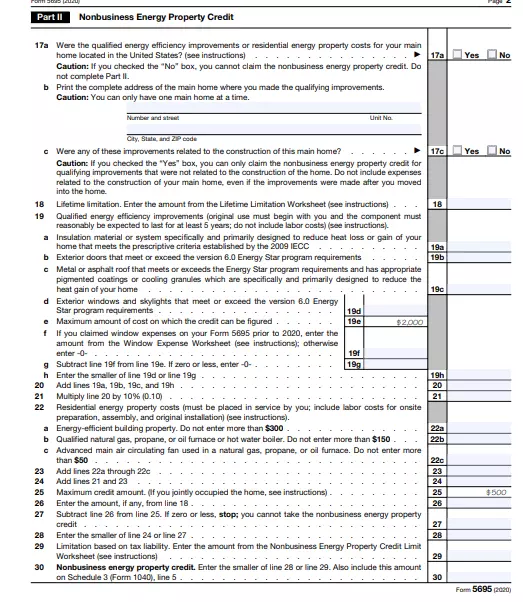

The tax credit youre eligible for is a percentage of the cost of alternative energy equipment thats installed on or in a home including the cost of installation. Next unless you also installed solar water heating equipment or a geothermal heat pump move on to line 6.

Wind Turbine Diy Opportunity For Investment Mothers Day Etsy Turbina Aerogenerador Ebay

Other AMT items See Instructions for Form 6251 18.

. Additional information Form IT-255 Claim for Solar Energy System Equipment and its instructions. How to apply. The renewable energy tax credit is for solar geothermal wind home insulation and other energy installments and improvements.

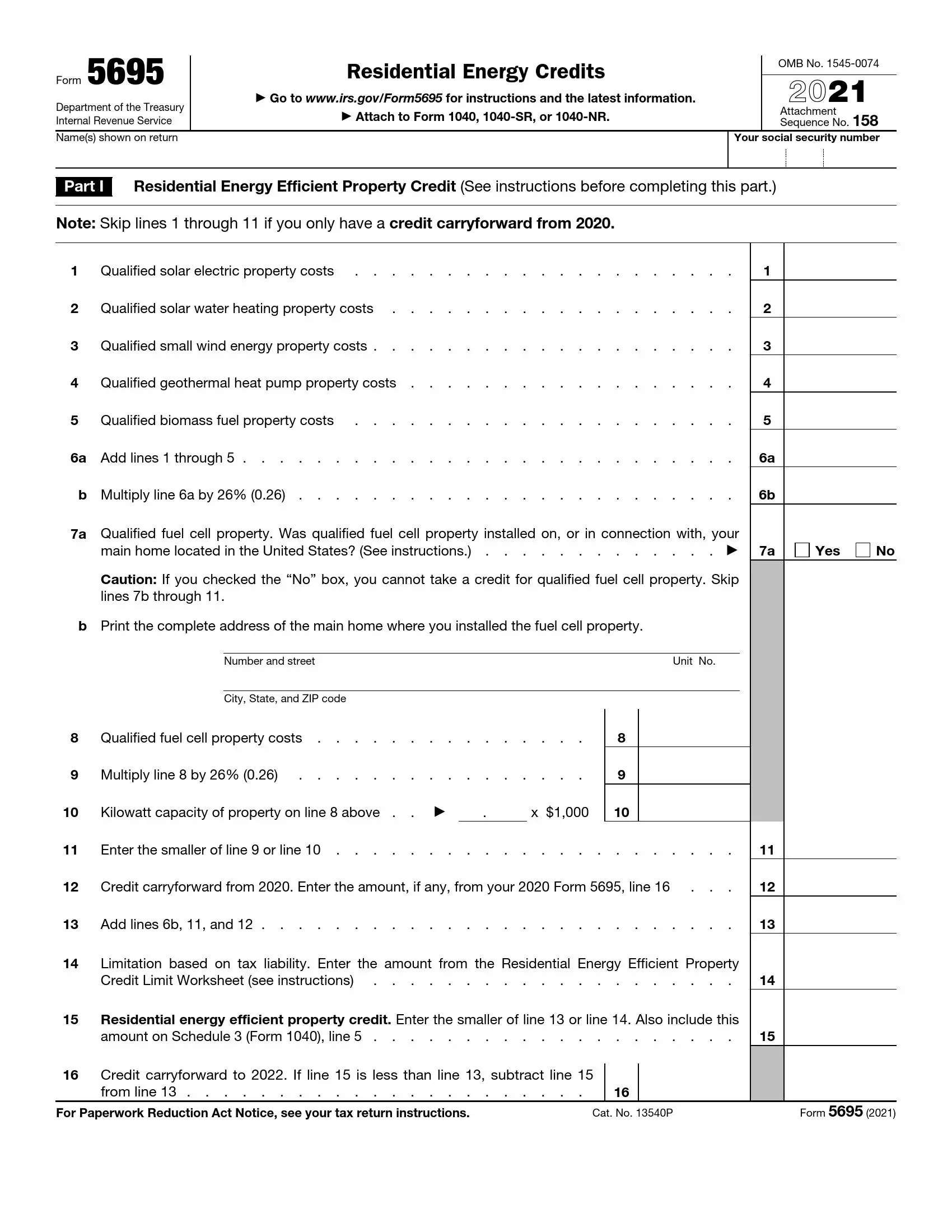

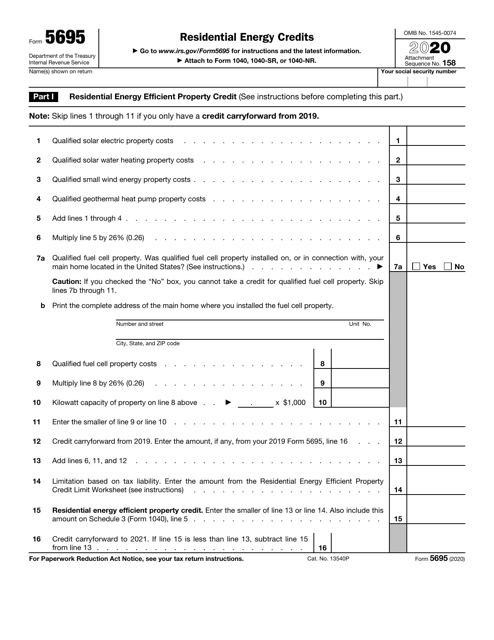

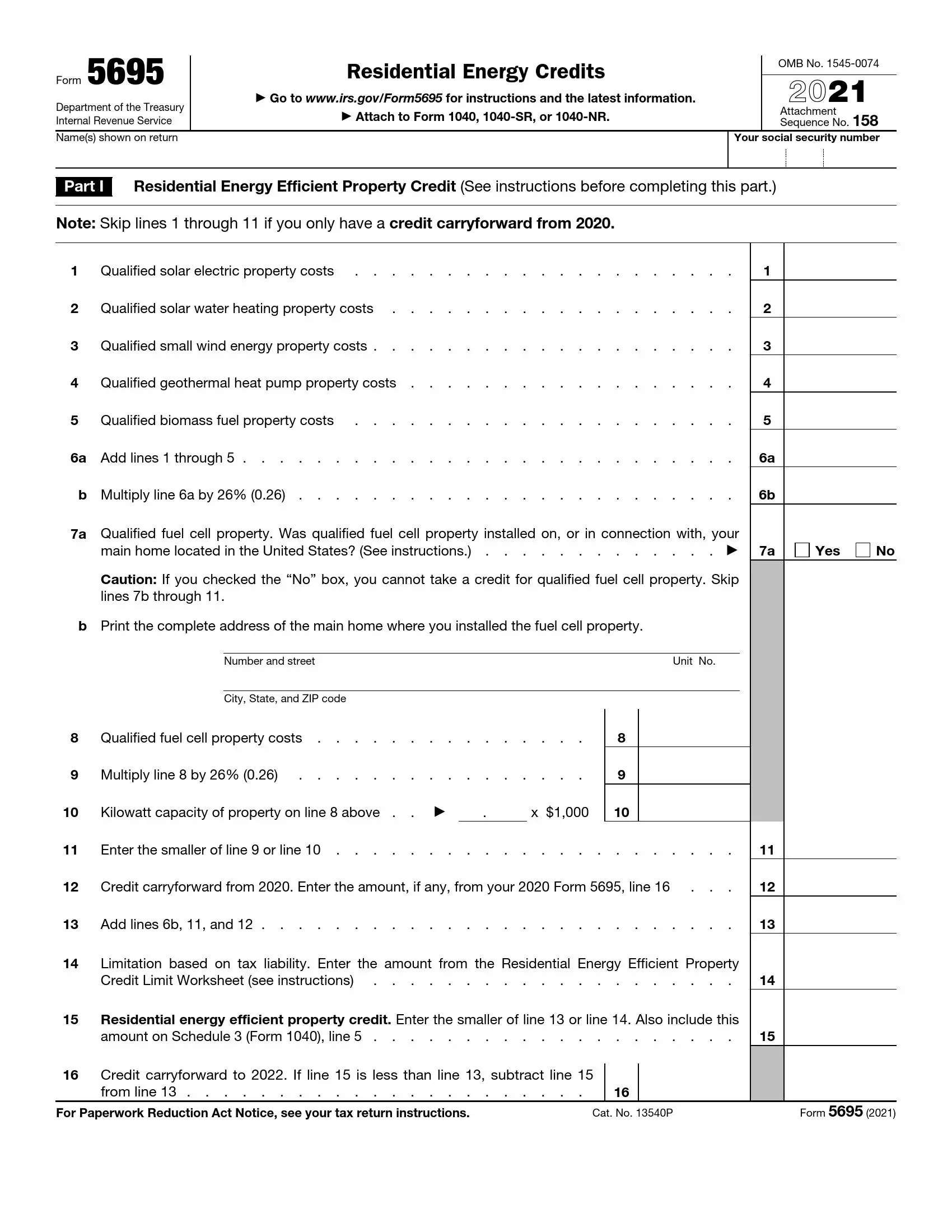

Homeowners who install geothermal can get the tax credit simply by filling out a form declaring the amount you spent when you file your federal income taxes. Geothermal Heat Pumps All of these pumps must conform to the standards of the Energy Star program. While ENERGY STAR supplies some information about tax credits here the tax credits are administered by the IRSYou will have to claim the credit using the form below and submitting it with your tax returns to the IRS.

However the taxpayer should retain this certification as part of their tax records. When it is tax time. Solar wind geothermal or other renewable energy equipment.

This includes the solar energy tax credit. Geothermal heat pumpsthese source the earths natural heat from the ground in order to provide heating air condition and hot water. Oil gas and geothermalgross income See Instructions for Form 6251 Code E.

Tax-exempt income and nondeductible expenses Code A. Installing a ground source heat pump is a large project so you might expect to pay between 10000 - 30000 on a system. Like the Clean Energy Tax Credit the amount you can get back is still 30 until the tax credit expires after 2032.

Waiting to the end of the calendar year or until tax filing season may cause the loss of this tax credit due to annual funding limits. Solar Electric System Loans FINANCING THE CLEAN ENERGY MOVEMENT. Basis of property using geothermal energy placed in service during the tax year see instructions.

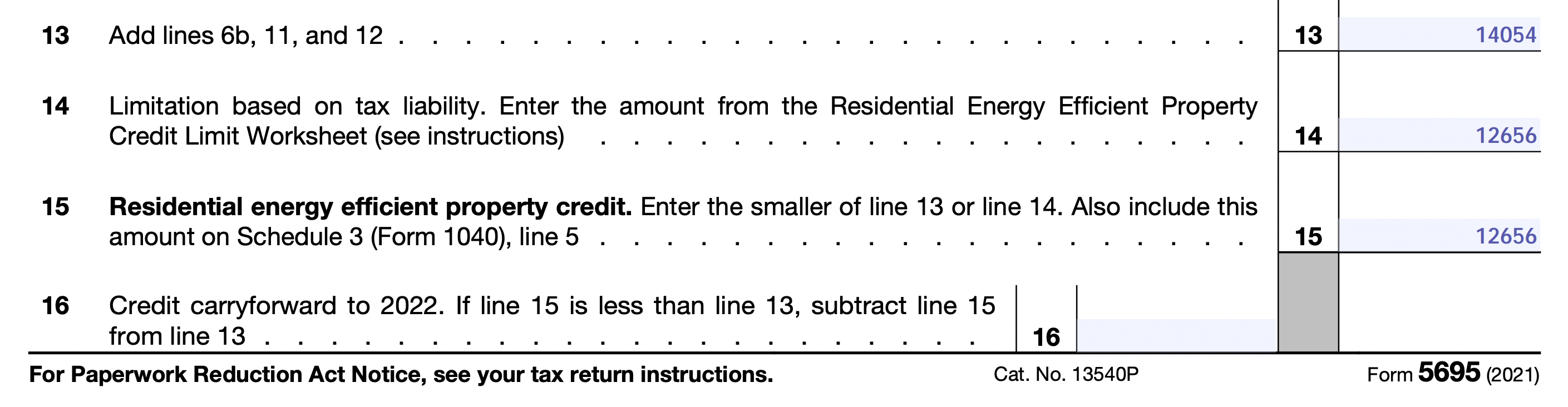

Form 3468 Department of the Treasury. Existing homes and new construction both qualify for this tax credit on purchases of. You will add up your various energy credits on IRS Form 5965.

Tax Credits and Deductions for Individual Taxpayers. If the federal tax credit exceeds tax liability the excess amount may be carried forward into future years. For installations completed in 2021 the maximum tax credit will be 1200.

By offering up to 100 financing with no money down our solar electric system loans allow you to harness the power of the sun and swap your monthly electric bill for a monthly loan payment on a solar electric systemone which you would later own free-and-clear at the end of the loan. When you submit your 2021 tax return file Form 5695 Residential Energy Credits here. For smaller homes with lower heating and cooling loads expect to be on the lower end of this.

After 2034 the credit will then become invalid. The total upfront cost of a ground source heat pump depends on many factors. The Geothermal Tax Credit covers expenses including labor.

Recovery and Reinvestment Act of 2009 included a tax credit for investments in manufacturing. How to file for the solar tax credit. For a period not to exceed 10.

The tax credit can be used to offset both regular income taxes and alternative minimum taxes AMT. This credit is allowed for a 5-year period beginning in the tax year that the qualified rehabilitated building is placed in service. Taxpayer will be required to execute an agreement in the form set forth in Appendix A of Notice 2013-12.

The solar energy system equipment credit is not refundable. Solar hot water heaters solar electric equipment wind turbines and biomass fuel cell property as of Dec. The Tax Cuts and Jobs Act of 2017 placed a 10000 limit on state and local tax deduction which may impact whether a state tax credit impacts federal taxable income.

How much does a ground source heat pump installation cost. Enter this tax credit off of form 5695 on your 1040 form. Oil gas and geothermaldeductions See Instructions for Form 6251 Code F.

The IRS is highly vigilant when determining whether to accept an application for a tax credit on Form 5695. The current tax credit allocation is 12 million. IRS Form 5695 instructions Updated 08232022.

Foreign Tax Credit Schedule 3 Form 1040 Part I line 1 _____ Credit for Child and Dependent Care Expenses Schedule 3 Form 1040 Part I line 2 _____ Credit for the Elderly or the Disabled Schedule R Form 1040 line 22. The end result of claiming a state tax credit is that the amount of the state tax credit is. The residential Solar PV tax credit is phasing out and currently installations completed in 2020 the tax credit is calculated as 25 percent of the eligible system cost or 1600 whichever is less for installations on residential dwelling units.

The taxpayer must execute and return the agreement to the IRS by January 10 2014. Fill out IRS Tax form 5695 and submit it with your taxes. 31 2021 are examples of equipment thats eligible for this tax credit.

Wind Turbines This credit only applies to specific wind turbines. As long as your system is up and running by the end of 2022 you can claim the 26 percent from your federal income taxes. Please visit our Solar Market Development Tax Credit Dashboard for information on number of projects certified and amount that has been allocated to date.

The geothermal heat pump tax credit is for 30 of the cost of the product including installation costs with no upper limit if it was placed in service by the end of 2019 and it. Tax-exempt interest income Form 1040 or 1040-SR line 2a Code B. You can claim the residential energy-efficient property credit using tax Form 5695 for primary residences as well as.

The First-Time Homebuyer Savings Account Subtraction may be claimed on Form 502SU by a Maryland resident who has not owned or purchased either individually or jointly a home in the State in the last 7 years and who has contributed money to a first-time homebuyer savings account. Enter the total of the following credits if you are taking the credits on your 2020 income tax return. Yes water-to-water geothermal heat pumps can qualify for the tax credit.

Use IRS Form 5695 to claim the Residential Energy Efficient Property Credit and theres no limit on the credit amount. IRS Notice 2009-41 suggests the taxpayer is not required to attach this certification statement to their tax return. However any credit amount in excess of the tax due can be carried over for up to five years.

Follow the instructions on.

Irs Form 5695 Download Fillable Pdf Or Fill Online Residential Energy Credits 2020 Templateroller

Form 5695 For 2022 2023 Energy Tax Credits

Irs Form 5695 Fill Out Printable Pdf Forms Online

Steps To Complete Irs Form 5695 Lovetoknow

Federal Tax Credit For Hvac Systems How Does It Work And How To Claim Step By Step Instructions

Download Form P87 For Claiming Uniform Tax Rebate Dns Accountants

Save Money With The Federal Solar Tax Credit And Other Renewable Energy Incentives

Form 5695 2021 2022 Irs Forms Taxuni

Instructions For Filling Out Irs Form 5695 Everlight Solar

Irs Form 5695 Fill Out Printable Pdf Forms Online

How To Claim The Solar Panel Tax Credit Itc

Form 5695 Instructions Information On Irs Form 5695

/4797-3b4366c079144f94baf030ecdfd05ed9.jpg)

Form 4797 Sales Of Business Property Definition

What Is Irs Tax Form 5695 The Dough Roller

How To File The Federal Solar Tax Credit A Step By Step Guide Solar Com

Tax Time Tips To Claim Your 30 Solar Credit

Federal Tax Credit For Hvac Systems How Does It Work And How To Claim Step By Step Instructions

Form 5695 Claiming Residential Energy Credits Jackson Hewitt